The 10 Golden Rules For A Successful Post-Merger Integration

- BOEDEC

- May 9, 2022

- 20 min read

Updated: May 10, 2022

Written by Patrick Boëdec, April 12th, 2022

Context :

Each one of us has already experienced, either directly or indirectly, a merger and probably still remembers a mechanical operation centered on the implementation of a new organization at a forced pace, with departures, search for synergies, change of tools, and triumphalist press releases using the "Pravda" method.

According to recent studies by McKinsey, KPMG and articles published in Harvard Business Review, the success rate of mergers is between 20% and 50% maximum. Les Echos even estimates that it would not exceed 15%, in the case of a merger between equals. Robert Sher, founder of "CEO to CEO" and author of "Feel of the Deal" defends the idea that the causes of these failures would come from poor risk management, overestimation of the acquisition price, lack of medium- and long-term strategy, inability to bring out a new culture or difficulties in managing the new organization.

Yet merging is nowadays an imperative if we consider the ROCE (Return on Capital Employed) as one of the flagship indicators, which most characterizes the neoliberal model.

In concrete terms, it is no longer just a matter of being profitable, in terms of EBITDA, to be attractive, but also of the capital employed in an activity. In this world, "Big Is Beautiful"! This indicator is directly linked to the calculation of the share value, which is itself the basis for the calculation of the variable remuneration of executives.

This also explains why speed is so important in this economic model; we must do more with less and above all, much more quickly, with the objective of reaching critical size in order to hope to be among the leaders of tomorrow.

We are therefore faced with a model that is fundamentally growth-oriented, where mergers and acquisitions are necessary to meet the expectations of shareholders and not to fall behind in this race to gigantism.

For two decades, we have been locked into a logic of massification, globalization and specialization of activities. The objective is to concentrate only on so-called "core business" activities with a high return on capital employed.

If we look at it from a geo-strategic point of view, this ratio is undoubtedly the one that has had the most impact on companies since it is at the origin of Western relocations, but above all, it has profoundly shifted the geo-strategic balance from West to East by creating tomorrow's "morning" superpowers such as China or India, so close are we to them.

Moreover, according to Trading Sat, the 100 companies collectively weigh 36,800 billion dollars in capitalization, which is almost the equivalent of the GDP of the US and Europe combined! So this movement of concentration, of search for critical size and therefore of mergers is not insignificant today and even less tomorrow since the 7 first world capitalizations have created last year, over the last 6 months, more value than the GDP of Germany.

If one equates capital employed, to some extent, with "fixed costs", the best way to increase profitability in this scheme is to grow, and the fastest way to grow fast is to merge.

On the other hand, the entities of a group have become, over time, Lego bricks, which are bought or sold according to their return on capital or their potential for growth on the world stage and therefore for capitalization for the shareholder.

If we return to the process of fusion as such:

A merger, in fact, takes place in two phases, just like a space launch by analogy.

The first phase allows us to get out of the earth's gravity, in concrete terms, it consists of setting up the organization, cleaning up the portfolio of activities and brands, realizing synergies and transforming the new size reached into profits, it is similar to an approach that I would describe as "productivity", i.e., delivering the organizational synergies, those that motivated the shareholders to carry out the operation. In my experience, companies are quite successful in bringing out a new organization and putting in place management tools. Nevertheless, it must be recognized that employees have no choice but to converge the tools to continue their activity and keep their customers. This is the " sovereign" mission of integration.

The second phase consists of placing the module in its final orbit. The same is true of mergers and acquisitions; the second phase of post-merger integration must bring out a new culture from the two histories and gradually create a new collective decision-making frame of reference. The first warnings generally appear at the end of the first year, as the teams are too busy dealing with regulatory issues. It is in this second phase that the success rate plummets.

A number of factors can explain this underperformance:

a) Employee fatigue after years of successive restructuring and upheavals, frustrations related to additional efforts that are generally not recognized or rewarded

b) procrastination, decisions that are slow in coming,

c) Half-measures that do not satisfy anyone

d) A vision that is not understood and devoid of meaning, beyond the short-term financial stakes, which gradually become obsessive

e) Rivalries between the entities, which inevitably lead to mistrust and a poisonous atmosphere.

f) ...

The most surprising thing is to note these difficulties of integration, if we put into perspective, the total amount of the merger or acquisition is that the cost of the second phase is totally marginal whereas it is this which perpetuates the profits of the operation.

Just like a launcher; 90% of the fuel is consumed at take-off, the same thing with an integration, the first phase engages the most financial and human resources. This stage is naturally fundamental, but it is not what will make the fusion a success in the medium and long term.

If we think "marginal", it is incomprehensible not to devote a little more means, attention, and energy to obtain much more!

I therefore propose 10 golden rules for a successful post-merger integration

1. Anticipate the cycles,

Q When I was a student, the long term was 5 to 7 years, the medium term 2 years and the short term 1 year. Today, the long term does not exceed 3 years, the recent events; Dieselgate, Covid, the invasion of Ukraine... shows that the future, beyond this period, is unpredictable...

Managing a company is above all about understanding where it stands in these cycles and providing it with all the assets to make it stronger in the next ones.

The medium term is now 1 year and the short term 6 months. Tomorrow, the generalization of artificial intelligence may reduce this period by half.

We are going to experience mutations, quantum technological leaps, and in-depth transformations of our ways of working, at a frantic pace.

The company is driven by multiple cycles (human resources, technological leaps, environmental constraints, appearance of new competitors, cultural changes, increased consumer expectations...).

This acceleration of cycles generates complexity both through mergers and successive integrations. But it is also created by the resulting size effect and the interdependencies between entities. If we also consider the increasing demands of the markets, we obtain complexity that adds up to complexity.

Only companies that have developed a very strong culture of adaptation, which is characterized both in the search for excellence and in the way of acting with pragmatism, favoring speed, the ability to unlearn, to bet on innovation... This way of thinking in an incremental way allows these groups to gain agility, a prerequisite for surfing from cycle to cycle. Doing a little more to get a lot more than the extra effort.

This diagram shows the incredible acceleration of economic cycles. Over the last 20 years, all companies have had to improve their processes and adapt their structure to a constantly changing environment. For example, the pharmaceutical industry has halved the time to market, thus converting new molecules into revenues and therefore into capitalization more quickly.

Another example, in the automotive industry, the average design time for a vehicle has been reduced from 48 to 36 months, with the objective of reaching 28 months by parallelizing tasks, simulating rather than testing, etc.

This acceleration of cycles generates complexity both through mergers and successive integrations. But it is also created by the resulting size effect and the interdependencies between entities. If we also take into account the increasing demands of the markets, we obtain complexity that adds up to complexity.

One only must look at groups as famous as Alcatel, Nokia, Arthur Andersen, Dexia, Monsanto, Evergrande, to a lesser extent Boeing weakened by the design errors of the 737, Casino, Ubisoft, GM, or the recurrent weakness of Renault shares, Carrefour, the list is endless... Some have disappeared, others are forced to move closer together or be absorbed cheaply. What all these companies have in common is the inability to jump from one cycle to the next.

On the other hand, at the same time, we have seen institutions like Accenture reinvent themselves by adding to the classic systems integration, all the new intelligent, self-learning tools, metavers, blockchain... to become the key player in these new environments.

The same is true for Pfizer and Moderna in their ability to have developed a vaccine in "record" time using a brand-new technology called "messengers" while Sanofi and Johnson & Johnson, Zeneca and others have not managed to do so.

The business continuum concerns all industries, let's take the example of the retail industry, it is always tempted, after having succeeded in its breakthrough in the discount market, to take advantage of the situation and insidiously increase prices, considering that the acquired competitive advantage would last forever. The result is always the same, after a few months, they become a brand with an expensive image. In the end, the brand squanders in a few months what it took years to build. The opposite of thinking marginal.

In fashion, over the last twenty years, we have gone from 2 collections to 4 with the appearance of the "Category killers" then to 12 with the new chains H&M, Gap, Zara... Soon this rhythm will be increased to one per week... To go from one cycle to another requires a complete overhaul of the organization and not only "cosmetic" adjustments. The old players who had adopted the attitude of the ostrich considering that their notoriety would protect them ad vitam æternam, have disappeared to the benefit of new entrants who themselves will disappear in the next cycle.

Even Jeff Bezos lucidly predicts this state of affairs and that "Amazon is not too big to fail. In fact, I predict that one day Amazon will fail. Amazon will fail. If you look at big companies, their lifespan tends to be more than 30 years. The difference is that the first ones will have stayed in the market for 50 years, while the others will have stayed for 10 years and the next ones for less than 5 years before being dethroned by companies that themselves"...

Moreover, we are facing a technological tsunami on our doorstep that will reshuffle all the cards in its path. Managers must acquire a wide range of skills to equip the organization with the necessary tools to meet the challenges of this acceleration.

2. A merger is the ambition to conquer, to increase its capacities of realization

Let's go back to the basics: the purpose of any merger is to take a new step in the capabilities to do, to acquire new skills and means, which until now were unattainable for each of the organizations taken individually. The goal is to adapt to changes in the environment, and to conquer new markets in the long term, to prepare, naturally, to merge again, as soon as the integration is complete.

Furthermore, technologies have become, without a doubt, the new barriers to entry; whereas it used to cost "One" to implement an ERP throughout a group, equipping it with intelligent infrastructures costs "ten times more".

As an example, one of the world's leading retailers recently presented its strategic plan, showing an investment in digital of three billion euros over three years, while Alibaba, a year earlier, spent 13 billion in 18 months... two double standards, two opposite trajectories.

Generally speaking, the investment gap accelerates over the years, the strong ones run faster and faster and the others stagnate before losing their attractiveness and then going into a negative spiral until the share price stalls.

In short, companies have no choice but to merge in order to reach critical size in their sector and thus gain access to these differentiating and even divisive technologies, if they had remained at their pre-merger size. These operations have therefore become essential growth vectors.

But the success of the merger lies in the ability to integrate the two entities to create a third one made of the strengths of the first two. To do this, the best way to operate is to find themes requiring an unparalleled level of operational excellence, which only the two entities, once united, will be able to achieve by aggregating their know-how.

In other words, converge, no longer under constraint, but by giving a shared meaning to this operation around an ambition. It is then that energies will federate in a common interest.

In this framework and in an exclusive framework, 1 + 1 = 3.

As we said, in the contrary case, the first stage will have consumed 90% of the fuel, without managing to put the project on orbit, in clear the investments will not see the expected return.

The marginal one, that focuses on the remaining 10% of fuel, not to set up an organization chart, but to make sure that all the cogs turn synchronously, in order to create a new unified culture.

By devoting a little extra resources, by redistributing, why not, a little of the gains to the actors of the change, by making sure that their work, their efforts made during this operation are recognized and rewarded, by making sure to give a collective meaning to the restructurings, by finding federating projects, then, and only then, will the integration be a success, and without any doubt, much more profitable than any other productivity approach.

Beyond profitability, the ultimate goal of post-merger integration is to get the new organization up and running so that it can pursue external growth as quickly as possible.

3. Pay attention of the inventory, to better manage the second phase

A successful merger is therefore, when all the employees in the control room on the unified screens speaking the same language, stand up to applaud the feat, putting the project into orbit, that is, a new group that is 100% operational.

performance cannot be underestimated to establish the attractiveness of the company and therefore its post-merger value... According to Bain, "The root cause of most failed transactions goes back to the beginning, to the diligence phase".

The quality of the due diligence, in the first stage of the merger, is fundamental since it represents the base 100; where you come from. This phase is also too often neglected, as managers are pushed to take action quickly, whereas they will have to refer to this inventory throughout the integration process, if only to manage resistance to change.

From an operational standpoint, the initial diagnosis formalizes the state of the art between the entities. It identifies the dysfunctions and limitations of each system. The process highlights best practices, selects the brands to be retained, harmonizes commercial policies, draws up the roadmap for the projects to be launched, establishes the financial objectives and the strategic challenges to be met, but also defines an "ideal" organization and the new jobs to be filled...

The organization chart must not be a combination of the two previous ones. It is in this first phase that the intensity of the effort is at its peak.

In a merger, a Win-Lose approach in the short term will always result in a Loss-Lose in the long term.

During the second phase, the teams consume much less fuel, but it is the most sensitive stage, the one where all the efforts made during the take-off will deliver the expected value. It is a matter of making organizational and managerial adjustments. In a way, placing the project on its orbital trajectory, i.e., bringing out a new culture from the first two.

This is the outcome, in this exercise, there can be no losers.

The work will be to bring out a new decision-making frame of reference, to describe a new personality for the organization, to highlight the unified beliefs, to communicate on the new values and ambitions...

For the employees, the merger must be a conquest, a challenge, which will push the limits of the knowledge and achievements of each of the old organizations so that there will be no more differences between the "before" and "now" entities.

4. An integration is always a sprint,

Given the scope and number of projects to be launched, the word sprint is certainly not an exaggeration given the expectations in terms of profitability and capitalization.

Integration means parallelizing activities, doing everything right away.

Managing business cycles is, without a doubt, a question of tempo. The imperative to reduce "Time to Market" is also a matter of acceleration, as is the need to achieve the objectives to be delivered at each "Quarter". It is therefore necessary to reconcile both short-term constraints and prepare for the future at the same time. In the context of a post-merger integration, this same imperative also exists, that of combining speed and vision.

To set new "revenue" ambitions by revisiting the business portfolio, defining what is "core" and "non-core" business, i.e., selling all non-strategic brands, to reinvest in the former, and thus repaying part of the acquisition debt with the gains made from asset disposals.

Une intégration post-fusion s'effectue toujours "à marche" forcée puisqu'elle débouche immanquablement sur une autre acquisition trois ans plus tard.

But also, to reduce costs, to let go of the " Task forces " of buyers to renegotiate contracts based on the new size of the group, to seek organizational synergies, to share and homogenize best practices, to redesign processes and systems... These gains will at the same time reassure the shareholders on the merits of the operation and again, reduce the acquisition debt, optimize the capital employed, by rationalizing the industrial and logistical capacity...

In this phase, the involvement of middle management is a condition for success, without which the integration would have no relay between the management teams and the base. Moreover, knowledge, staffing, the representativeness of diversities, the transmission of knowledge, the chain of command and therefore the results, all these integration levers are definitely within the competence of this population, which cannot be ignored in their role and even less neglected in the implementation.

The integration cycle generally lasts three years for multinationals and two for large ETIs. This is the time needed to both clean up the balance sheet and set up a new organization while carrying out the activities mentioned above.

Nevertheless, it is important not to lose sight of the fact that, as of the first half of the year, shareholders will need to be reassured by the first tangible results of the merger.

The Stellantis timetable is a good example of this system of growth by acquisition; Carlos Tavarès became CEO of Peugeot in 2014; he spent three years restructuring the organization, rebalancing the accounts, and making the company attractive again. He acquired Opel in 2017, a new integration cycle that lasts until 2020 when it merges with Fiat Chrysler to create this new group.

As a result, Stellantis shows an insolent profitability in 2021 (equivalent to that of LVMH or Total Energy over the same period). In February 2022, Carlos Tavarès announced a doubling of turnover by 2030. This clearly means two new major mergers between now and then.

The current critical size in the automotive industry is 10 million vehicles, and will undoubtedly reach 15 million by then, which suggests that consolidation in this industry will accelerate. Other manufacturers will naturally follow suit, to keep pace with this accelerating growth.

5. Find immediate results,

Action should always be favored over reflection as we have seen previously. It is therefore recommended to look for quick results both for profitability reasons and to create credibility.

Finding immediate gains is the best motivational fuel for teams and it will allow you to tackle more complex, more political issues.

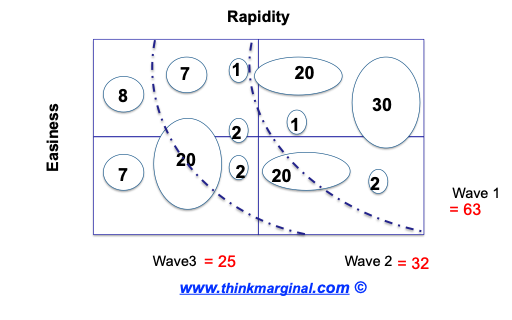

A good technique is to list all the activities to be launched and map them on a matrix showing the degree of difficulty and the degree of speed. Simply organize the "waves" of actions according to perspectives and constraints, i.e., start with what is quick and easy.

For example, in consulting, consultants always manage, when the scope allows it, to include a "Supply Chain" project in order to produce savings in the ultra-short term and to be constantly in positive cash flow, the gains covering their fees.

4. Be pragmatic,

The best is often the enemy of the good. The search for improvement is often a waste of time when a solution already "does the job". There is nothing worse than undoing to redo.

Marginal thinking is based on pragmatism, keeping only what gives an immediate result, for a reduced effort, turning away from the wastes inherent to the unique thinking, from everything that is dogmatic.

For example, to include entities in a coercive scheme for the sake of uniqueness, if this homogenization did not produce incremental value, this approach would not make any sense.

We often remain prisoners of these first convictions when nothing is ever set in stone. You must be ready every day to unlearn how to challenge your habits and opinions.

Example, A plastics group, following several acquisitions, found itself at the head of a metal parts machining entity; although these components were destined for the same customers, the nagging question came up at regular intervals in the management committee as to the validity of keeping this "exotic" activity, so far removed from the sacrosanct "core business", "blowing polypropylene"...

The discussions were dogmatic, on this "anomaly" in the portfolio of activities, but it was clear that the profitability of this division was insolent, a real jewel.

The team that had to decide on the future of this activity had been "strongly" invited by the management to "kill the duck once and for all" and to find official, even rational, reasons to sell this cumbersome asset that so strongly tainted the "identity" of the group.

After long hours of fruitless exchanges, the group's HR director suddenly cried out, "Come on, let's all be reasonable, you're talking about "core business"? I'll tell you my definition of core business, it's where we make money, and in this case, you can't be more core than that!"

Very quickly, everyone agreed on this obvious fact.

The person who had been given this task; to give up the activity, lost a vertebra with each argument supporting the idea of keeping it, lamenting on how he should communicate to the management, our decision.

The team as a whole came to support him to explain his position, the CEO at the time almost looked pleased. "I will inform the shareholder of your decision," he said, "just like that.

The subject, to my knowledge, never came up again...

There are always three ways to solve a problem, the easy way, the complicated way, and the heroic way. Avoid choosing the second, and even less the third, if you are looking for any technical prowess. You will inevitably reduce your chances of success, there is no halo of glory to be gained from failure. Always favor the shortest route, the most pragmatic and quickest solution. Observe and adopt what works for others, don't try to be smarter if others have been smarter for you.

"The fringe is about not spreading yourself too thin in the search for complicated solutions when simple solutions can be applied."

Ralph Stacey proposed a matrix representing both the degree of certainty about the solution to be delivered and the level of agreement between parties on a proposed solution.

As a result, the less agreement you have with your action and the greater the uncertainty of success, the more you reduce your chances of success.

The endless American "Make it simple and stupid" has its virtues...

7. Be uncompromising about sharing knowledge and respecting others

Of all the battles to be fought, respect is by far the most important in an integration. I have been involved in mergers where people hated each other just because they worked differently.

In the case of a post-merger integration, getting people to work together, with the greatest respect for their art, is a condition for success. It is essential that management regulate these sterile territorialities that risk compromising or slowing down the necessary homogenization of practices and know-how. One of the techniques used to achieve this result is to agree on the selection criteria for a common tool that will become the new standard for the entities.

Another way, if the subject matter allows it, is to redefine a third way which would be the aggregation of the first two technologies.

It is longer, more expensive, but if it is a perennial design and it is perfectible, why not, if the business case allows it. "Isn't it said that Paris is worth a mass?"

Example,

The formwork war!

In the construction industry, two models of formwork coexisted in the subsidiaries. A formwork is a formwork element in which concrete is poured to make large flat surfaces, or sections of walls.

The rationalization of this equipment made it possible to achieve substantial savings, not only on the unit cost but also because it was time to renew an ageing fleet, and therefore on large quantities. It must be admitted that a formwork panel requires some technical expertise, but it is still a formwork panel, albeit an elaborate one, but still a formwork panel...

Nevertheless, each subsidiary fought point by point not to concede any inch of ground to the "enemy" in order to keep their formwork, the one they had designed, and which made them proud.

In short, a battle of egos. It should be noted that the walls of the two branches were just as straight as each other, regardless of the material used.

I experienced the same scenario with the "product" repository in the retail sector after a merger. The teams fought for months to keep theirs without any concession.

Endless examples...

8. Create heroes in the first phase to embody and promote the new values,

Energy is focused on what is visible, what is embodied. A result must be attributed to a team or an identified leader who can magnify a feat. In a merger, leaders are needed, "heroes" because they illustrate the new ways of doing things, of working, the new practices resulting from the mixing of the two entities.

They represent the third way towards which everyone must converge. The results obtained serve as a guarantee of the validity of the transformation.

Like the Soviet propaganda that created a hero of productivity in Stakhanov in order to stimulate the other workers to increase their pace, the heroes serve as examples, they symbolize the values that the company wishes to promote in terms of behavior, of actions. I admit, the example of Stakhanovism is probably perfectible, but it is the most famous of the history books if we exclude Marvel's superheroes.

They are obviously vectors of communication, through their achievements, the company redefines the contours of good and evil, the conventional and the extraordinary. The company thus conveys the new values expected but also shows the opportunities that the new size of the group can offer in terms of career management.

Creating "heroes" is a real gas pedal for the emergence of a new culture.

9. Making a new DNA,

DNA is made up of stories, successes, daring, breakthroughs, genius, work, and effort. Each entity has its own genes; as such, a merger is definitely not a graft, but the formation of a new chain composed of the highlights of each of the stories.

Whatever the methods of integration, these genes are indelible, nothing can erase them. They constitute the resilient memory of each of the organizations; there will always be the "blues" and the "reds". This collective unconscious can be called "nostalgia", "resentment", "trauma" but there is nothing to stop it being transformed into enthusiasm through action.

In short, the challenge is to create a new way of identifying, appreciating, prioritizing, and acting, in short, to imprint new values in the DNA by bringing out a decision-making reference system.

The best indicator of success in this process is measured in community "pride of belonging". This is a second reason to create winners; nothing can be built on ruins, on sand. We must find deep foundations, anchored in the past, to build a new launch pad, to give meaning to this new size and capacity. The best vectors for creating this support, these rallies, remain the level of ambition and innovation, the desire to break new ground.

We need to rediscover that magic fiber, those stars in the eyes of the conquerors, that contagious, always positive flame that acts like a magnet and crystallizes creative energies.

10. Democracy stops where the common interest is at stake

It is understandable to consider the inertia of part of the organization in the face of change; psychologists hammer home the point that the human being is not a switch where it is not enough to decide for the person to apply; that it is necessary to go through a necessary phase of crossing the "valley of death" and of mourning, in order to better, afterwards, accept the change. So be it!

On the other hand, it is not tolerable to let a form of guerrilla warfare take hold that would be motivated by problems of misplaced ego, power issues or even less of precedence.

The collective interest always takes precedence over the individual interest and the cemeteries are, as everyone knows, full of irreplaceable people.

Lenin said: "Democracy starts with three and that makes two too many"; a great democrat as everyone knows... Nevertheless, in an organization, there is a time for consultation and a time for execution, literally and figuratively!

Example,

During a merger between two computer manufacturers, the CEO in charge of the operation gave as first instruction to build the best possible organization for a company of one hundred and twenty thousand employees. To be visionary and to equip it with the skills that new technologies impose on a group of this size, in short to play the next move.

The second instruction was not to take anything from the two former organizations. On this point, the message was clear: "If I see another name other than mine on an organization chart, whatever the function, hierarchical level or country, I will fire that person immediately.

The consultants therefore worked to define a target organization. Once validated, the implementation did not drag on; in the first month, the first rake was appointed, in the second month, levels 2 and 3 were appointed worldwide, in the third month, the last positions were assigned.

This was the most expeditious merger I have ever witnessed. If the first phase of the launch went smoothly, the second, the convergence phase, was underestimated in terms of load and attention. Beyond this productive phase, it took 10 years and many "dilutive" recruitments for a new culture to really emerge.

In the end, drawing an organization chart is not "doing the job", making the organization work and creating the conditions for employees to work together in respect and enthusiasm is. This is the third way to go.

Behind the often-mixed claims, reservations of all kinds, existential questions about the operational phase of the merger: "Will we compromise quality? Is the organization really ready for such a change? Is this the right time for it? Are we not going too fast"? All these tricks to gain time often hide personal issues, losses of territoriality, challenges to established powers or castes, which are difficult to accept for those who hold them.

In these situations, nothing should hinder speed.

At the end of these 10 lines of thought, post-merger integration is an exciting transitional period between two logics of action, two organizational philosophies, behind two ambitions, two short- or long-term deadlines, two conceptions of corporate cultures. It is managed with a watchmaker's screwdriver.

Post-merger integration is not a job for experts, nor is it a top-down job, and even less a production-oriented process.

The success of this essential step is directly linked to the level of ambition, the degree of innovation that is directly implied and a lot of common sense and listening. A successful integration is when everyone, whatever their level, understands that the future that is coming is more promising than the present situation and enough for the employees to want to create it to live it.

Comments